utah county food sales tax

Report and pay sales tax electronically on Taxpayer Access Point TAP at taputahgov using the template for form TC-62M Sales and Use Tax Return. The latest sales tax rates for cities in Utah UT state.

50 Off Deli Style Sandwiches Deli Style Sandwiches Deli Style Food

59-2-13511 Tax sale -- Combining certain parcels -- Acceptable bids -- Deeds.

. Wales UT Sales Tax Rate. A county-wide sales tax rate of 08 is applicable to localities in Utah County in addition to the 485 Utah sales tax. Sales by county -- Notice of tax sale -- Entries on record.

Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice. Some cities and local governments in Utah County collect additional local sales taxes which can be as high as 16. 2022 Utah state sales tax.

Help us make this site better by reporting errors. Utah County UT Sales Tax Rate. Has impacted many state nexus laws and sales tax collection requirements.

This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. Always consult your local government tax offices for the latest official city county and state tax rates. That is 18550 more than they would.

Please note that our offices will be closed November 25 and November 26 2021 for the Thanksgiving Holiday Pay over the phone by calling 801-980-3620 Option 1 for real property. It is assessed in addition to sales and use taxes on sales of food prepared for immediate consumption by retail. What you will find in the US which is different from some other countries is that when you see the price of a product such as a t-shirt in a retail store or food.

The December 2020 total local sales tax rate was also 7150. 272 rows Utah Sales Tax. The 2018 United States Supreme Court decision in South Dakota v.

The Utah County Sales Tax is 08. Monday - Friday 800 am - 500 pm. The Utah County sales tax rate is.

Judy Weeks Rohner R-West Valley City talks about HB165 and HB203 which both aim to eliminate the states sales tax on food during a press conference outside of the Capitol in Salt Lake City on Tuesday Feb. County Finance Office Elections. 2020 rates included for use while preparing your income tax deduction.

Rates include state county and city taxes. Ad Automate sales tax compliance in the programs you use with Avalara AvaTax plugins. In the state of Utah the foods are subject to local taxes.

Both food and food ingredients will be taxed at a reduced rate of 175. Tuesday marked the 15th day of the Utah Legislatures 45-day session. 100 East Center Street Suite 1200 Provo Utah 84606 Phone.

The December 2020 total local sales tax rate was also 7150. The Utah County Tax Administration office does not provide any advice legal or otherwise to any prospective buyer beyond answering questions related to the procedures of administering the sale. Used by the county that imposed the tax.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

What you need to pay online. Vernal UT Sales Tax Rate. The Utah state sales tax rate is currently.

Wallsburg UT Sales Tax Rate. Average Sales Tax With Local. Back to Utah Sales Tax Handbook Top.

Virgin UT Sales Tax Rate. To pay Real Property Taxes. Exact tax amount may vary for different items.

Counties may adopt this tax to support tourism recreation cultural convention or airport facilities within their jurisdiction. Uintah County UT Sales Tax Rate. Utah has several different counties 29 in total.

93 rows This page lists the various sales use tax rates effective throughout Utah. Wanship UT Sales Tax Rate. Veyo UT Sales Tax Rate.

Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. The current total local sales tax rate in Utah County UT is 7150. However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465.

The table combines the base Utah sales tax rate of 625 and the local county rates to give you a total tax rate for each county. If you need access to a database of all Utah local sales tax rates visit the sales tax data page. The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and a 025 special district sales tax used to fund transportation districts local attractions etc.

Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. Vineyard UT Sales Tax Rate. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state sales tax rate of 175.

Restaurants must also collect a 1. 6 rows The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax. Time is running out for those bills.

Free sales tax calculator tool to estimate total amounts. The current total local sales tax rate in Utah County UT is 7150. The seller collects sales tax from the buyer and pays it to the Tax Commission.

Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart. Utah County UT Sales Tax Rate. These transactions are also subject to local option and county option sales tax and that results in a total combined rate on grocery food of 3 throughout the state of Utah.

Vernon UT Sales Tax Rate. Utah has state sales. Utah has a 485 statewide sales tax rate but also has 127 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 211 on top of the state tax.

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov.

Judy Weeks Rohner Utah Should Cut The Tax On Food Not The Income Tax

Utah Sales Tax Small Business Guide Truic

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Is Food Taxable In Utah Taxjar

Lawmakers Try Again To Eliminate Food Tax In Current Session

The Grill Sergeant Utah Food Truck Utah Food Trucks Food Truck Food

Sales Tax On Grocery Items Taxjar

Utah Should Stop Taxing Groceries Completely Opinion Deseret News

Pandemic Has Eased Jobs Are Back Why Are Utah Food Pantries Still Busy

Review Blueberry Lemon Funnel Cake At Hungry Bear Restaurant In Disneyland The Disney Food Blog Funnel Cake Lemon Blueberry Lemon Frosting

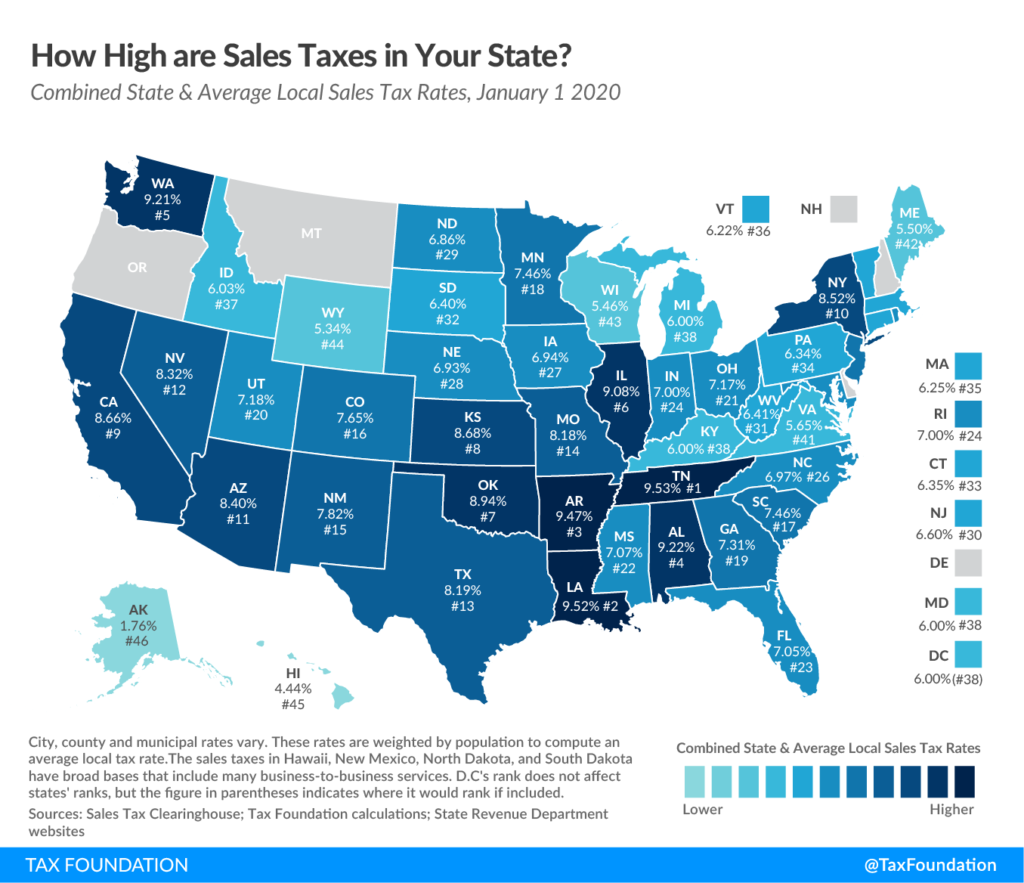

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

U K Food Poverty Surges 57 In Just Three Months In 2022 Food Poverty Consumer Price Index Energy Prices

Arive Homes Leah Bonus Kitchen Home New Homes Kitchen Remodel

Some Utah Food Stamp Recipients Will Get Extra Bump In Benefits

The Best Of Utah 25 Unique Hikes For Your Bucket List Hiking Destinations Utah National Parks Hiking

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

Utah S Recent Sales Tax Reform Efforts And Sales Taxes Across The Nation Utah Taxpayers