does the irs forgive back taxes after 10 years

The debt is wiped from the books by the IRS. The IRS has 10 years to collect taxes that are not paid.

Help With Irs Debt 11 Ways To Negotiate Settle Tax Debt

Continue reading to learn more on tax debt forgiveness after ten years.

. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. 10 years Generally under IRC 6502 the IRS will have 10 years to collect a. Does the IRS Forgive Tax Debt After 10 Years.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. The day the tax debt expires is often referred to as the. This is called the 10 Year.

How far back can the IRS collect unpaid taxes. Does the IRS forgive back taxes after 10 years. Does the IRS forgive back taxes after 10 years.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. This is called the 10 Year Statute of Limitations. After that the debt is wiped clean from its books and the IRS writes it off.

Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of. The IRS generally has 10 years to collect on a tax debt before it expires. September 21 2022 Jessie.

As a general rule of. Does The Irs Forgive Tax Debt After 10 Years. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

You may feel overwhelmed and uncertain about what to do. Its not exactly forgiveness but similar. This means the IRS should forgive tax debt after 10 years.

Does Irs Forgive Tax Debt After 10 Years. Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of limitations on. Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of.

It is not a matter of the IRS forgiving taxes after 10 years. After this 10-year period or statute of limitations has expired the IRS. Answer 1 of 8.

After that the debt is wiped clean from its books and the IRS writes it off. After that the debt is wiped clean from its. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

In general the Internal Revenue Service has 10 years to collect unpaid tax debt. After this 10-year period or statute of limitations has expired the IRS can. However there are a.

Tax debt can be scary. By law the IRS has 10 years to collect a tax after assessing it which means entering the tax. This is called the 10 Year.

What You Need To Know About Irs One Time Forgiveness

Can You Negotiate Your Back Taxes With The Irs

Does The Irs Forgive Tax Debt After 10 Years

Can The Irs Collect On A 10 Year Old Tax Debt

Irs Debt Forgiveness And Irs Tax Forgiveness Services

Does The Irs Forgive Tax Debt After 10 Years

Tax Debt Relief How To Handle Back Taxes Ramseysolutions Com

2020 Guide To Irs Tax Debt Relief Get Free Help For Tax Problems Forget Tax Debt

Can The Irs Collect After 10 Years Fortress Tax Relief

Tax Help Guide Resources On Tax Resolution Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

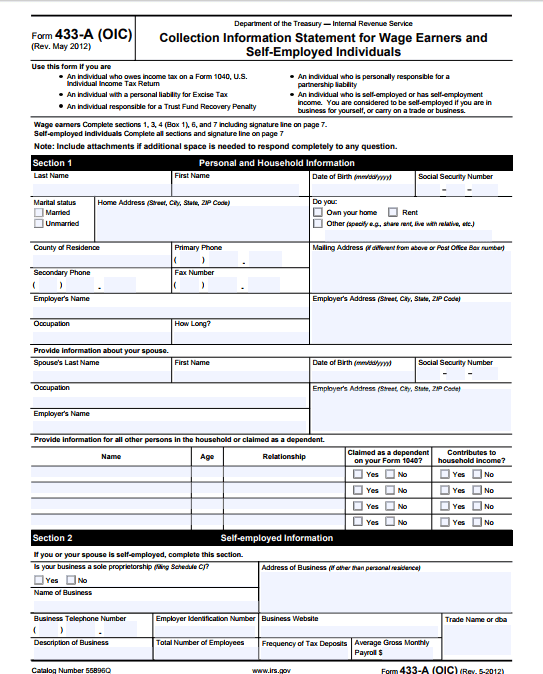

Irs Debt Forgiveness Program Here S How To Apply Supermoney

Know What To Expect During The Irs Collections Process Debt Com

Collection Statute Expiration Date Csed Tax Group Center

Does The Irs Forgive Tax Debt After 10 Years Sort Of Tax Attorney Explains Expiring Tax Debts Youtube

Tax Debt Relief Irs Programs Signs Of A Scam

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Everything You Need To Know About Irs Tax Forgiveness Programs