closed end funds leverage risk

Capital does not flow into or out of the funds when shareholders buy or sell. Closed-end funds have the ability to use leverage which can lead to greater.

Closed End Funds Definition Pros Cons Seeking Alpha

Discounts and Leverage Risk in Downturns With market sentiment a key driver of CEF discounts it should be no surprise that closed-end funds trade at larger discounts during market sell-offs.

. The shock to the funding of closed-end funds led to an opportunity to explore the connections between funding liquidity risk and market prices. This gives portfolio managers flexibility to borrow at low rates and invest in higher-yielding assets. Ad With Best-in-Class Trading Tools No Hidden Fees Trading Anywhere Else Would be Settling.

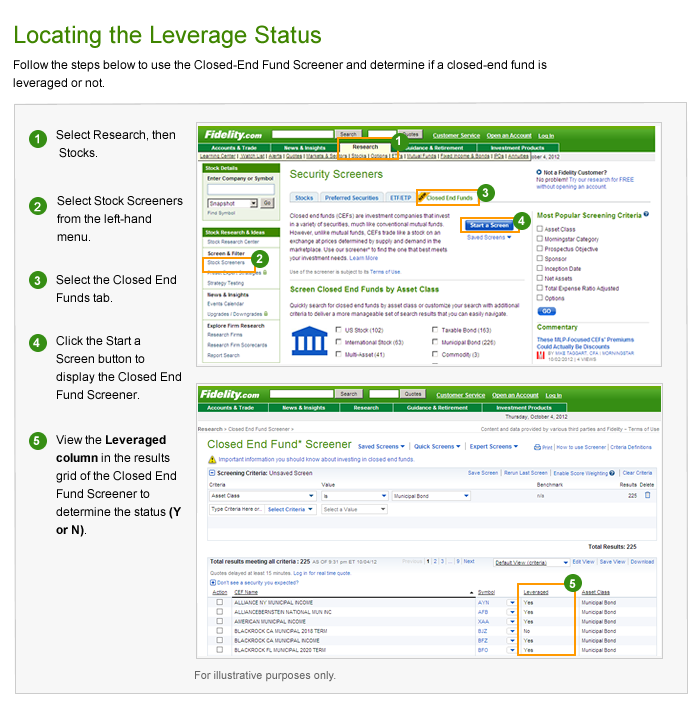

Fund managers are able to. Industry regulations limit the amount of leverage that a fund can assume. Closed-end funds are a type of investment company whose shares are traded in the open market like a stock or ETF.

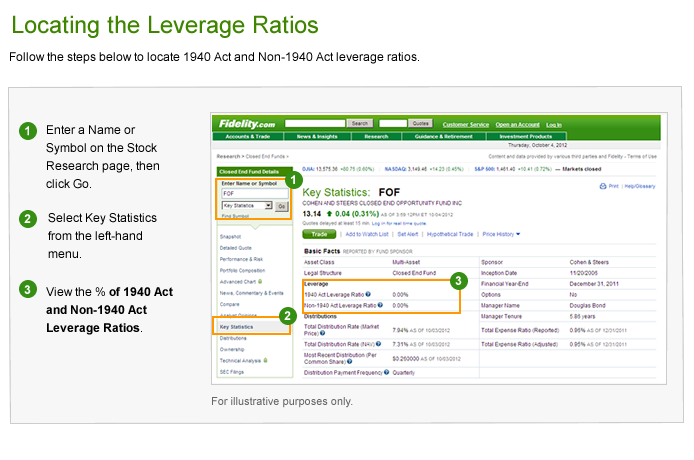

And unlike regular open-ended mutual funds closed-end funds are allowed to employ leverage and when it came from debt and preferred shares it was called 1940 Act. High Dividend Stock Specialists. Closed-end funds use of leverage can.

Ad Reduced single fund risk with a portfolio of CEFs managed by top fixed-income managers. The first four funds are the of the aggressive andor leveraged type CEFs and they include the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund ETO 2880. Closed-end funds may use debt or other leverage more than other types of investment companies to purchase their investments.

Leverage the ability of closed-end funds to issue debt or raise money through the sale of preferred shares is a unique feature of closed-end funds. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. What this means for you.

If interest rate costs get too high the fund will be. Increasing leverage in a closed-end bond. Diversified by asset strategy manager.

At the end of the funds fiscal year on Feb. They can also make heavy use of leverageborrowed moneyto boost their returns. In fact the Nuveen fund has a 38 leverage ratio which means.

In addition many CEFs may use leverage up to 3333 under SEC regulations. The negative side of the leverage knife can result in an investment death spiral for a highly leveraged closed-end fund. Closed-end funds operate more like ETFs in that they trade throughout the day on a stock exchange.

Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than 100 of their investment capital. Ad Free List10 Best Closed-End Funds. As a result closed-end funds may be able to offer higher overall returnsthan their open.

The fund charges a 055 management fee on both its regular and leveraged. 28 it had 13 billion in leveraged assets. Choose From Over 60 Funds With 4 5 Star Ratings From Morningstar.

Most closed funds use leverage borrowing to invest more than assets to boost their returns and distributions. Most but not all closed-end funds have the ability to use leverage in an attempt to enhance returns. Key benefits 01 Stay fully invested Closed structure allows for greater flexibility in the types of investment strategies that can be used and helps portfolio managers stay invested for the.

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

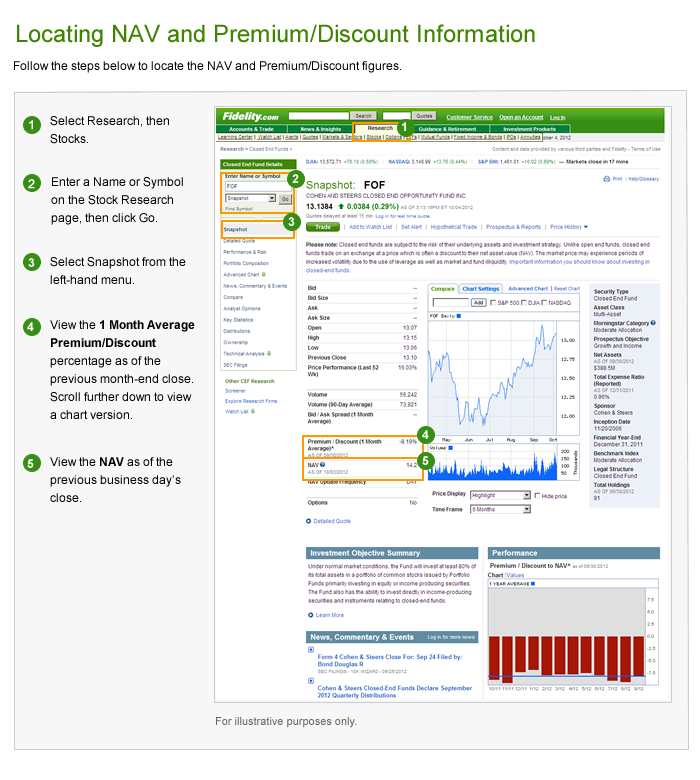

Closed End Fund Leverage Fidelity

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Closed End Funds Calamos Investments

What Are Closed End Funds Fidelity

5 Best High Yielding Closed End Funds To Buy

Guide To Closed End Funds Money For The Rest Of Us

5 Best High Yielding Closed End Funds To Buy

Is It Time To Consider Muni Closed End Funds Blackrock

What Are Mutual Funds 365 Financial Analyst

5 Best High Yielding Closed End Funds To Buy

Guide To Closed End Funds Money For The Rest Of Us

5 Best High Yielding Closed End Funds To Buy

Investing In Closed End Funds Nuveen

What Is The Difference Between Closed And Open Ended Funds Quora

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Closed End Fund Leverage Fidelity

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends